The last Word Guide to Purchasing Bullion: A Wise Investment in your F…

페이지 정보

Bobbye Hooten 0 Comments 3 Views 25-08-22 22:01본문

Investing in bullion has turn into an increasingly widespread alternative for people looking to diversify their portfolios and safeguard their wealth. Bullion, typically in the type of gold, silver, platinum, or palladium, provides a tangible asset that may function a hedge against inflation and financial uncertainty. This article goals to provide a complete information to buying bullion, exploring its benefits, the completely different varieties out there, and the very best practices for making a purchase order.

Understanding Bullion

Bullion refers to precious metals that are traded primarily based on their weight and purity somewhat than their face value. The mostly traded types of bullion embrace coins, bars, and rounds. Bullion coins, such because the American Gold Eagle or the Canadian Maple Leaf, are minted by government authorities and are acknowledged worldwide for their quality and authenticity. Bullion bars, then again, are produced by personal mints and are available various sizes, usually ranging from one ounce to a number of kilograms. Rounds are just like coins however will not be thought of legal tender.

Why Spend money on Bullion?

- Inflation Hedge: One of the primary reasons buyers turn to bullion is its historical skill to retain worth during intervals of inflation. In the event you loved this article and you want to receive more details with regards to buying gold online is safe kindly visit our own website. As fiat currencies lose purchasing energy, valuable metals tend to hold their worth, making them a beautiful possibility for wealth preservation.

- Market Volatility Protection: buying gold online is safe Bullion can serve as a safe haven during instances of economic instability. When stock markets fluctuate or geopolitical tensions rise, buyers often flock to precious metals, driving up their prices.

- Diversification: Together with bullion in an funding portfolio will help diversify risk. Precious metals have a low correlation with traditional asset courses corresponding to stocks and bonds, which means they will present stability when different investments are underperforming.

- Tangible Asset: Not like stocks or bonds, bullion is a bodily asset that you would be able to hold in your hand. This tangibility can provide peace of mind, particularly throughout unsure economic instances.

Types of Bullion to purchase

When considering an funding in bullion, it’s essential to grasp the differing types out there:

- Gold Bullion: Gold is the most popular form of bullion investment. Investors often buy gold coins or bars, with the price usually decided by the present spot value of gold, plus a premium for minting and distribution.

- Silver Bullion: Silver is one other favored option, usually seen as a extra reasonably priced various to gold. Silver bullion is on the market in both coins and bars, and whereas it could have a decrease worth level, it may be just as unstable as gold.

- Platinum and Palladium: These metals are less generally traded however can offer distinctive investment alternatives. They are sometimes utilized in industrial applications, which can affect their market value.

How to Buy Bullion

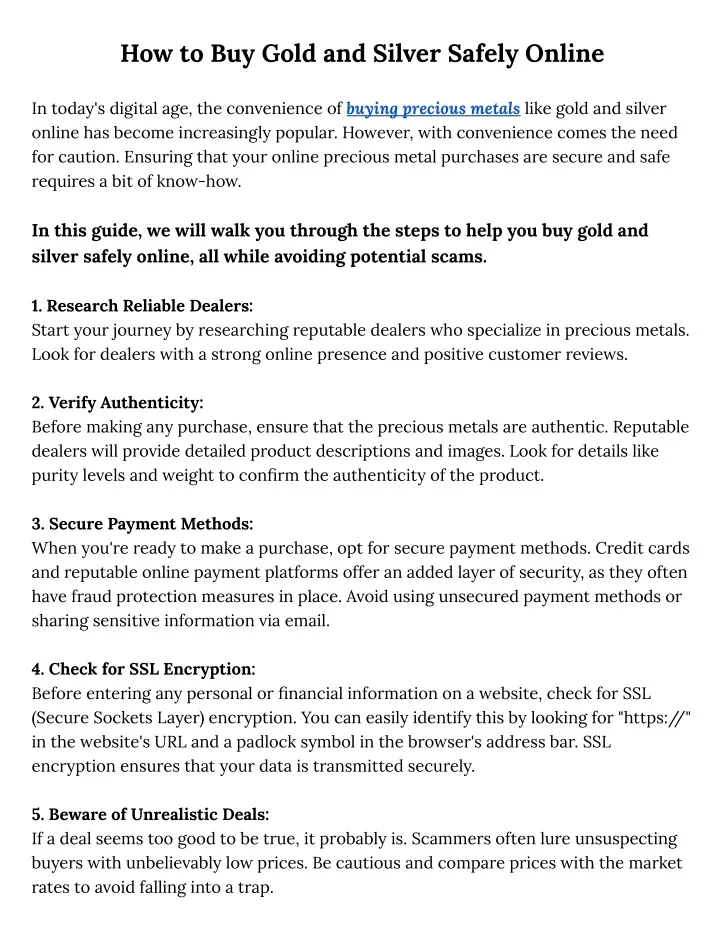

- Research Reputable Sellers: Earlier than making a purchase, it’s essential to research and select a good bullion supplier. Look for sellers with positive customer critiques, transparent pricing, and a strong observe report in the trade.

- Understand Pricing: Bullion costs fluctuate based mostly on market situations. Familiarize yourself with the spot price of the metallic you would like to purchase and perceive the premiums charged by dealers. Premiums can fluctuate primarily based on the type of bullion, the seller, and market demand.

- Choose the appropriate Form: Resolve whether you wish to put money into coins, bars, or rounds. Consider elements resembling liquidity, storage, and your funding goals when making this resolution.

- Consider Storage Options: If you’re buying a big quantity of bullion, consider how you'll retailer it. Choices embrace house safes, bank safety deposit bins, or professional storage facilities that provide secure, insured storage on your valuable metals.

- Keep Information: Maintain detailed data of your purchases, including receipts, certificates of authenticity, and any relevant documentation. This data can be important for tax purposes and whenever you resolve to promote your bullion sooner or later.

Promoting Bullion

Sooner or later, chances are you'll determine to sell your bullion. Understanding the selling course of can enable you maximize your return on investment:

- Know the Market: Simply as with buying, it’s important to be aware of the present market conditions when selling bullion. Monitor the spot price and market developments to determine the perfect time to promote.

- Select the right Seller: When selling, consider returning to the supplier from whom you bought the bullion. Many respected dealers will buy back bullion at competitive prices. Alternatively, you can discover on-line marketplaces or auction websites.

- Be Ready for Premiums: Simply as consumers pay premiums when buying bullion, sellers may also encounter lower presents resulting from vendor markups. Be prepared for this when promoting your metals.

- Understand Tax Implications: Promoting bullion could have tax consequences, as earnings from the sale could possibly be topic to capital features tax. Seek the advice of with a tax professional to understand how selling bullion will impression your tax situation.

Conclusion

Investing in bullion is usually a sensible choice for these looking to diversify their portfolios and protect their wealth against inflation and financial uncertainty. By understanding the different types of bullion, researching reputable sellers, and following greatest practices for purchasing and promoting, you can make knowledgeable choices that align with your financial goals. Whether you choose to invest in gold, silver, platinum, or palladium, bullion presents a tangible asset that can provide stability and security in an ever-changing financial panorama. As with any funding, it’s important to conduct thorough research and consider your risk tolerance earlier than diving into the world of bullion.

댓글목록

등록된 댓글이 없습니다.